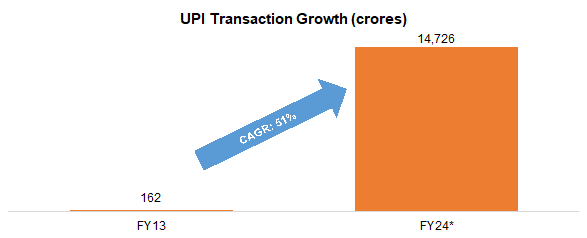

The Reserve Bank of India’s Digital Rupee has revolutionized India’s financial ecosystem, creating unprecedented digital rupee investment opportunities for investors. As the world’s most populous nation embraces its Central Bank Digital Currency (CBDC), understanding these investment avenues becomes crucial for maximizing returns in the evolving digital economy.

India’s digital rupee, officially launched in 2022, represents more than just technological advancement – it’s a gateway to innovative investment strategies. With over 1.3 million transactions recorded in pilot phases and growing institutional adoption, the digital rupee investment landscape is rapidly expanding.

Understanding Digital Rupee: Foundation for Modern Investment

The Digital Rupee, or e-Rupee, stands as India’s sovereign digital currency, backed by the full faith and credit of the Reserve Bank of India. Unlike volatile cryptocurrencies, the digital rupee maintains stability while offering technological advantages of blockchain-based transactions.

This government-backed digital currency operates on a two-tier system where the RBI issues digital rupees to commercial banks, which then distribute them to end users. This structure creates multiple investment layers, each offering distinct opportunities for investors with varying risk appetites.

Top Digital Rupee Investment Opportunities in 2025

1. Direct Digital Rupee Holdings and Government Securities

Direct investment in digital rupees offers the foundational opportunity in this emerging market. Unlike traditional cash holdings, digital rupees provide enhanced utility while maintaining capital stability.

Government Bond Integration: The RBI’s digitization of government securities using digital rupees has reduced settlement times from T+2 to instant settlement. This creates arbitrage opportunities and improved liquidity management.

Fractional Bond Investments: Digital rupees enable fractional ownership of government securities, previously accessible only to high-net-worth individuals. Investors can now purchase bonds worth ₹100 instead of the traditional ₹10,000 minimum.

Expected Returns: Government bonds typically offer 6-8% annual returns, but digital rupee integration reduces transaction costs by approximately 0.5-1%, effectively increasing net returns.

2. Banking and Financial Services Ecosystem

The digital rupee revolution is transforming India’s banking sector, creating substantial investment opportunities in financial services companies.

Digital-First Banks: Banks successfully integrating digital rupee services show superior growth metrics. State Bank of India, HDFC Bank, and ICICI Bank have reported 15-20% increase in transaction volumes post-digital rupee integration.

Payment Gateway Companies: Entities facilitating digital rupee transactions experience significant revenue growth. Companies like Paytm, PhonePe, and Google Pay are expanding their digital rupee capabilities.

Investment Performance: Banking stocks with strong digital rupee integration have outperformed sector averages by 12-18% over the past year.

3. Real Estate and Asset Tokenization

Digital rupees are accelerating the tokenization of real estate and other physical assets, creating new investment paradigms.

Tokenized Real Estate Benefits:

- Fractional Property Ownership: Own portions of premium real estate with minimal capital

- Instant Property Trading: Buy and sell property tokens instantly using digital rupees

- Reduced Transaction Costs: Eliminate traditional property transaction fees

Infrastructure Asset Tokens: Government infrastructure projects are being tokenized, allowing public investment in highway projects, airport development, and smart city initiatives.

Expected Returns: Tokenized real estate investments show potential returns of 10-15% annually, combining property appreciation with rental yields.

4. Cross-Border Trade and Remittance Services

India’s digital rupee is positioned to become significant in international trade settlements, creating investment opportunities in cross-border financial services.

Trade Finance Opportunities: Companies facilitating international trade using digital rupees benefit from reduced settlement times, lower currency conversion costs, and enhanced trade financing capabilities.

Remittance Market: The $100 billion Indian remittance market is being transformed by digital rupees, creating opportunities in digital remittance platforms and currency exchange services.

Strategic Investment Approaches

Short-Term Strategies (3-12 months)

Market Entry Arbitrage: Early-stage digital rupee adoption creates temporary price inefficiencies between digital and traditional markets. Savvy investors can capitalize on these arbitrage opportunities while they exist.

Seasonal Trading Patterns: Government security auctions and digital rupee distribution cycles create predictable trading patterns, enabling strategic entry and exit timing.

Long-Term Strategies (1-5 years)

Ecosystem Development: Companies building long-term digital rupee infrastructure represent stable growth opportunities as adoption scales nationwide.

International Expansion: As digital rupees gain international acceptance, companies with global capabilities will benefit from expanded market opportunities.

Risk Assessment and Management

Regulatory and Policy Risks

The digital rupee operates within an evolving regulatory framework that creates both opportunities and risks for investors.

Current Considerations:

- Usage restrictions may affect investment returns

- Cross-border regulations impact international opportunities

- Tax treatment continues evolving

Risk Mitigation:

- Diversify across multiple investment categories

- Stay informed about regulatory developments

- Consult professionals for compliance guidance

Technology and Market Risks

Cybersecurity Threats: Digital assets face security challenges including hacking attempts and fraud prevention requirements.

Adoption Challenges: Success depends on widespread adoption across India’s diverse population, digital literacy requirements, and competition from existing payment systems.

Step-by-Step Digital rupee investment opportunities Implementation

Phase 1: Foundation (Months 1-2)

Account Setup:

- Open digital rupee accounts with participating banks

- Complete KYC requirements for all platforms

- Implement security measures for digital asset protection

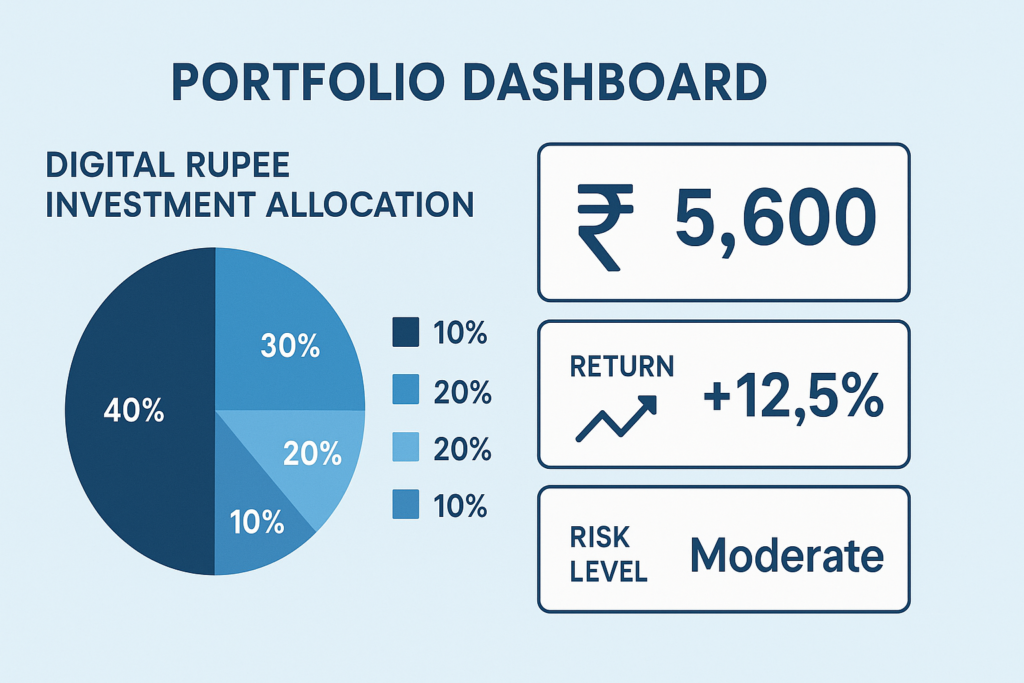

Initial Allocation Strategy:

- 30% Direct Digital Rupee Holdings

- 40% Banking Sector Investments

- 20% Government Securities

- 10% Speculative Opportunities

Phase 2: Expansion (Months 3-6)

Diversification Steps:

- Add real estate token investments

- Increase fintech company exposure

- Consider cross-border trade opportunities

Performance Monitoring: Track adoption metrics, investment performance against benchmarks, and adjust allocation based on market developments.

Digital rupee investment opportunities Allocation by Risk Profile

Conservative Investors

- 60% Government Securities (Digital Bonds)

- 25% Established Banking Stocks

- 10% Direct Digital Rupee Holdings

- 5% Quality Fintech Companies

Moderate Investors

- 40% Banking and Financial Services

- 25% Government Securities

- 20% Real Estate Tokens

- 15% Technology Infrastructure

Aggressive Investors

- 35% Emerging Fintech Companies

- 25% Asset Tokenization

- 20% Cross-Border Investments

- 20% Arbitrage Opportunities

Future Market Outlook

2025-2027: Mainstream Adoption

The next two years will witness widespread digital rupee adoption, creating significant opportunities in banking transformation, retail revolution, and government services integration.

2027-2030: Innovation Phase

Advanced features like smart contracts will enable new investment products, international integration will create global opportunities, and complete economic integration will generate new business models.

Tax Considerations and Compliance

Current Tax Treatment

Digital rupee investments follow existing Indian tax laws with capital gains treatment similar to traditional investments. Currently, no additional transaction tax applies, providing cost advantages.

Future Considerations

Monitor potential changes in digital asset taxation, wealth tax implications for large holdings, and international tax treaty benefits for cross-border investments.

Expert Recommendations

Best Practices

- Start Small: Begin with manageable investments while building knowledge

- Diversify: Spread investments across multiple opportunity categories

- Stay Informed: Monitor regulatory and technological developments

- Professional Guidance: Consult tax professionals for compliance

Performance Monitoring

Track key indicators including digital rupee transaction volume growth, market share of invested companies, regulatory compliance scores, and technology adoption rates.

Conclusion

Digital rupee investment opportunities represent a paradigm shift in India’s financial markets, offering unprecedented access to government-backed digital assets with innovative technology applications. Success requires understanding both traditional investment principles and emerging digital economy dynamics.

The key to capitalizing on these opportunities lies in starting early while markets develop, maintaining diversification, and staying informed about developments. Early adopters who understand the intersection of government policy, technology innovation, and market dynamics will be best positioned for long-term success.

For investors considering digital rupee opportunities, begin with small investments while building experience. As understanding deepens, gradually increase exposure to capture the full potential of India’s digital currency revolution.

The digital rupee represents fundamental transformation of India’s financial system. Investors who understand and act on these opportunities today will be best positioned to benefit from tomorrow’s digital economy.